A lot can be said of Bulgaria, with respect to the recent years of economic growth and development on the European path, but among the most impressive and remarkable achievements are the business opportunities it offers.

Not many people are aware of the fact, that currently Bulgaria is in the world top 10 list of countries with fastest internet connection and 3rd in the world as of IT specialists per capita. The capital city – Sofia ranks 2nd among the Top 10 fastest growing Tech centers in Europe in terms of annual grouth of active members in the ecosystem. Global IT R&D leaders like SAP Labs, HP, Bosch, VMware, IBM, CISCO operate large R&D centers in Bulgaria already. Financial Times – one of the world’s leading business news and information organisations recently moved to Bulgaria one more of its key teams in the field of development of technologies and digital products.

The Covid-19 crisis showed to the global and EU leaders how unprepared we are and how much we depend on the biggest factory in the world – China, with respect to supply. Many EU countries started to reconsider their production and organization strategies, trying to find near-shore destinations. Having in mind factors as its geostrategic location, low taxation, well trained and educated labour force, the Bulgarian government is launching more and more incentives in order to attract and stimulate European producers to move part of their currently positioned in China production lines into Bulgaria.

Because of the Brexit situation, the UK’s service sector, which accounts for some 80% of the country’s GDP, will lose the right to cater to EU clients. In order to maintain access to this market, companies are pushed to set up offices in the EU in a bid to minimise the negative fall-out they expect Brexit will cause to their businesses. The whole import and export ecosystem will suffer from delays, the time it takes for payments to be processed and received will most likely increase, leaving many businesses short of funds. SMEs are facing questions like what if import prices are higher, delivery times longer or overhead costs to your business are permanently increased?

Many EU jurisdictions are preparing not only to mitigate the risk and negative consequences of Brexit, but also on how to attract UK based bussinesses to relocate to EU.

Bulgaria, with its friendly business environtment, great tax benefits, low business costs such as rental and real estate, utilities, labour cost and government incentives to attract foreign investors, may offer many good reasons and opportunities for relocation of business.

A stable economy and bank sector, second lowest public debt in Europe combined with the absence of ethnical tension and immigrant issues qualify Bulgaria as a strong competitor among the rest of the EU jurisdictions.

Seting up a Bulgarian company on its own or as part of an international structure could be a very good option for those decided to opt for plan B – Еxit from Brexit.

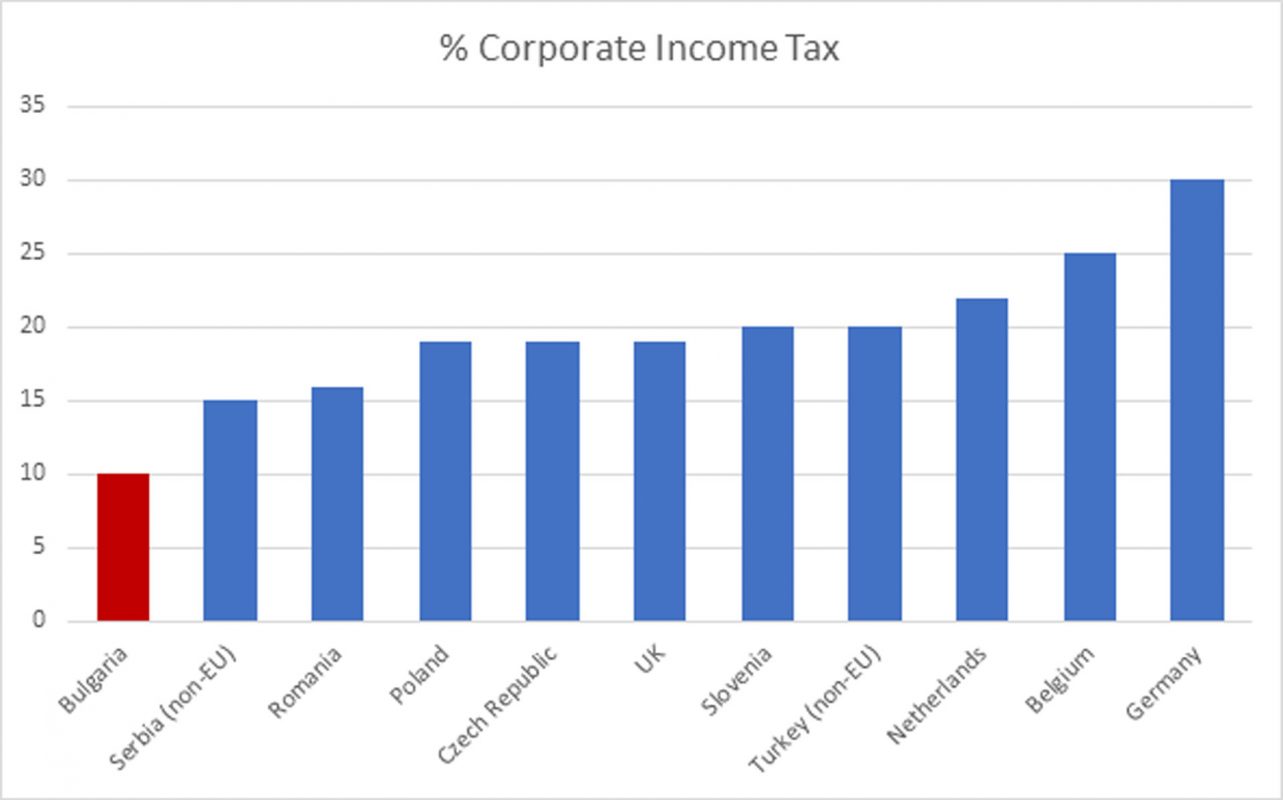

Bulgaria is an outstanding example for a low-tax jurisdiction, and at the same time it has an excellent reputation in terms of compliancy and transparency, which makes it a first-class EU jurisdiction for doing business and settling a trading or a holding company, as well as a perfect choice for tax residency jurisdiction for any European entrepreneur.

THESE ARE THE MAIN FEATURES OF

THE BULGARIAN TAX SYSTEM FOR BUSINESSES:

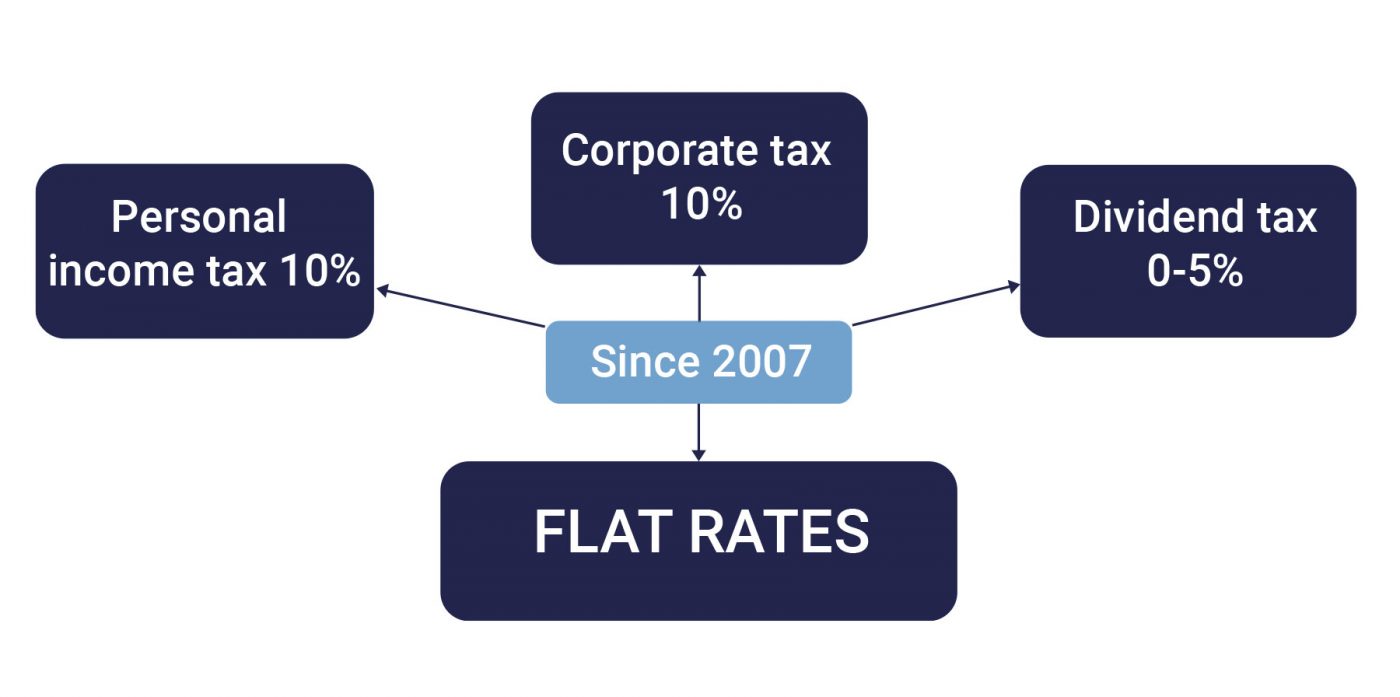

- 10% Flat Corporate Profit Tax

- 0% Corporate Profit Tax in zones with unemployment 25% or higher than average

- 0-5% Dividend Tax

- Maximum monthly social insurance cost of €500 per employee

- Double taxation avoidance treaties with 80 countries

Bulgaria has been applying successfully its friendly tax regime, based on flat taxation where a single tax rate is applied to all levels of income since 2007.

Saving taxes is one of the reasons why many business people and companies have chosen to set up a company in Bulgaria. But running business in Bulgaria is beneficial, not only because of the lowest taxation in EU, and also due to one of the most competitive business costs in Europe, friendly business environment, fast and easy procedures and perfect investment opportunities.

In 2020 FDI intelligence ranked the capital Sofia 3rd in business cost effectiveness among major European cities. With €1.54, Bulgaria has the lowest total employer cost per €1.00 of the net salary in EU.

TAXATION RATES 2020

THE BULGARIAN TAX SYSTEM MAIN FEATURES FOR INDIVIDUALS ARE:

- 10% Flat Personal Income Tax

- 0% inheritance Tax

EU citizens are allowed to apply and obtain Bulgarian Tax Residency which gives the opportunity for an individual to take advantage of the lowest personal income taxation of just 10% (including capital gains) in EU and become a tax payer in Bulgaria for his worldwide global income.

Български

Български Nederlands

Nederlands